Muinmos

Investment type: minority investment

Strategic rationale: growth capital to further develop the sales and marketing team in continental Europe

Finovate Capital has invested in muinmos'. Cloud-based PASS software instantly and globally categorises clients in accordance with MiFID II in the EU or as equivalent in the rest of the world (KYCC). Munimos instantly determines whether a financial institution can on-board a client to trade in a particular service (KYS), product (KYP) and country (KYCO) whilst performing the full suitability and/ appropriateness assessments. It also clears the anti-money laundering requirements (AML) by using a traffic light rating system with full detailed breakdown of the results.

Metafused

Investment type: minority investment

Strategic rationale: growth capital for product development

Metafused is a FinTech + AI driven company targeting innovation of traditional banking & finance processes by using AI/ML & predictive analytics. Metafused is based in London and works today with many of the global banks based in London and other key banking Capitals like Frankfurt, Singapore, Dubai and New York.

Huddlestock

Investment type: minority investment

Strategic rationale: growth capital to scale the business in Europe and Asia

Huddlestock is a Norwegian FinTech company established in late 2014. The company is fully regulated by BaFIN in Germany with a license to operate and market its platform in most European countries. Huddlestock creates a marketplace for investors to find sophisticated investment strategies. The company is one of Norway’s leading crowd-trading platform that allows users to tap into investment ideas and strategies usually only available to professional investment managers.

GC Exchange

Investment type: minority investment

Strategic rationale: Seed capital for further product development, marketing and sales

Based in London, GC Exchange Limited (GCEX) part of the GC Group was established in 2018 in response to demand for regulated and compliant exposure to the Cryptoasset market for professional clients. GC Exchange Limited is authorised and regulated by the Financial Conduct Authority (FRN 828730).

The company offer a range of Cryptoassets, Currencies, Commodities and Clearing products with tight spreads and deep liquidity.

Koine

Investment type: minority investment

Strategic rationale: pre-series A investment

Koine offers segregated, institutional custody & settlement of digital assets, providing essential Financial Market Infrastructure (FMI).

This brings together the full suite of governance, compliance, risk management and audit of real-world asset trading to the digital asset ecosystem for the first time. Institutional clients can engage with digital assets while fully adhering to regulated market practices.

Koine’s 'Digital Air Lock' technology embeds ‘EAL7+’ military grade security to secure digital assets and prevent them being compromised.

Ydentity

Investment type: minority investment

Strategic rationale: pre-series A investment

Subscription based personal data monitoring hub (online and mobile) helps protect clients data against: data fraud prevention, credit scoring and dark web monitoring

We have deep relationships among property & casualty and life solutions providers. Our team specializes on front office through the middle office, core systems and back office, including insurance-focused BPO providers.

We have deep relationships among property & casualty and life solutions providers. Our team specializes on front office through the middle office, core systems and back office, including insurance-focused BPO providers.

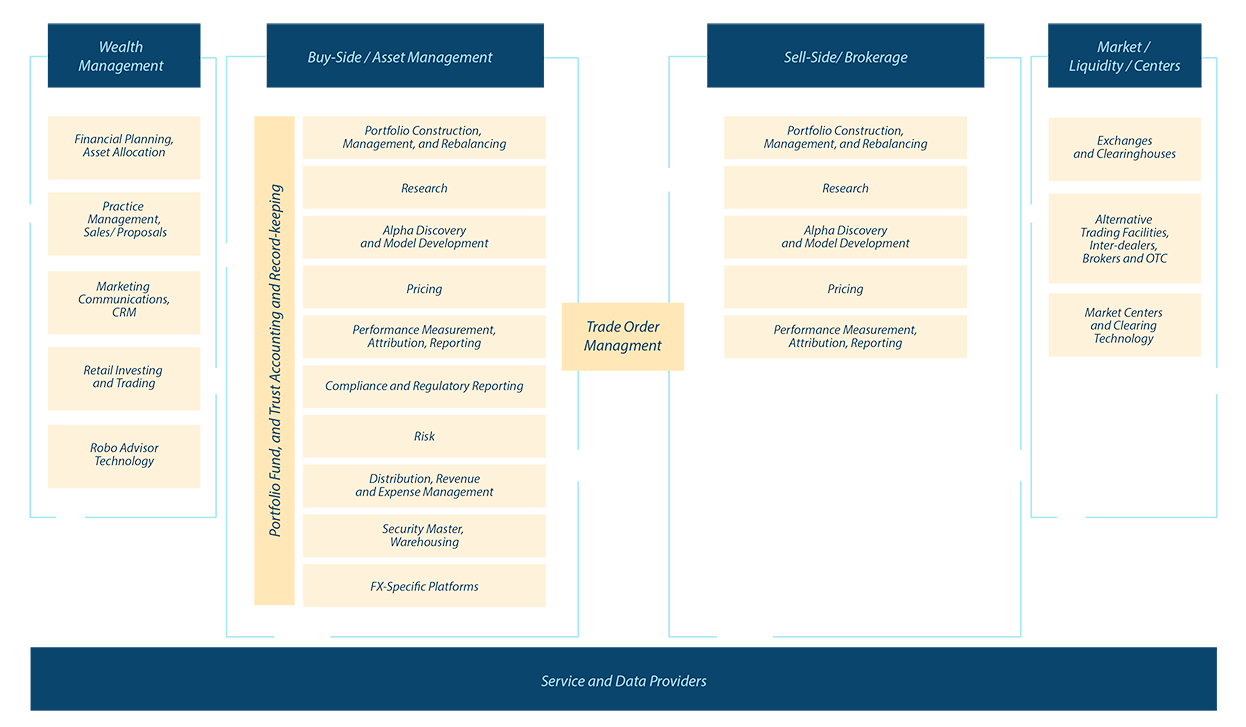

Within capital markets, we focus on software and solutions providers enabling sell side best execution, transaction cost analysis, post-trade and settlement for FX. Our coverage spans this value chain and includes all asset classes and security types.

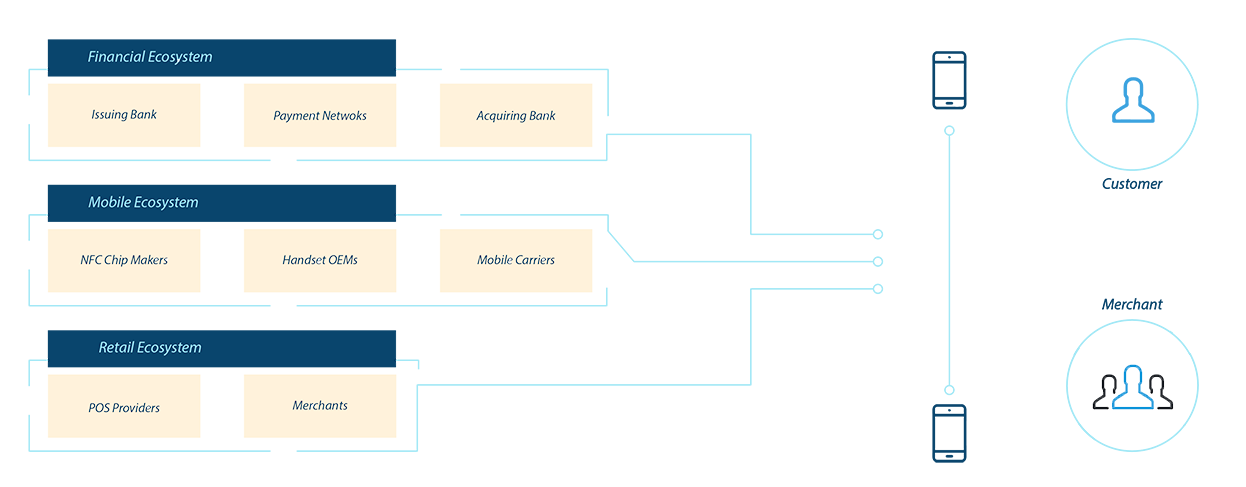

Within capital markets, we focus on software and solutions providers enabling sell side best execution, transaction cost analysis, post-trade and settlement for FX. Our coverage spans this value chain and includes all asset classes and security types. We expect a wave of M&A activity in the next 3 years as payment providers look to catch up with widespread innovation from new entrants, the internet majors scale up in financial services and the technology/software majors add new technology to deepen their offerings in this sector. We have unprecedented access to global investors; we know what they are looking for.

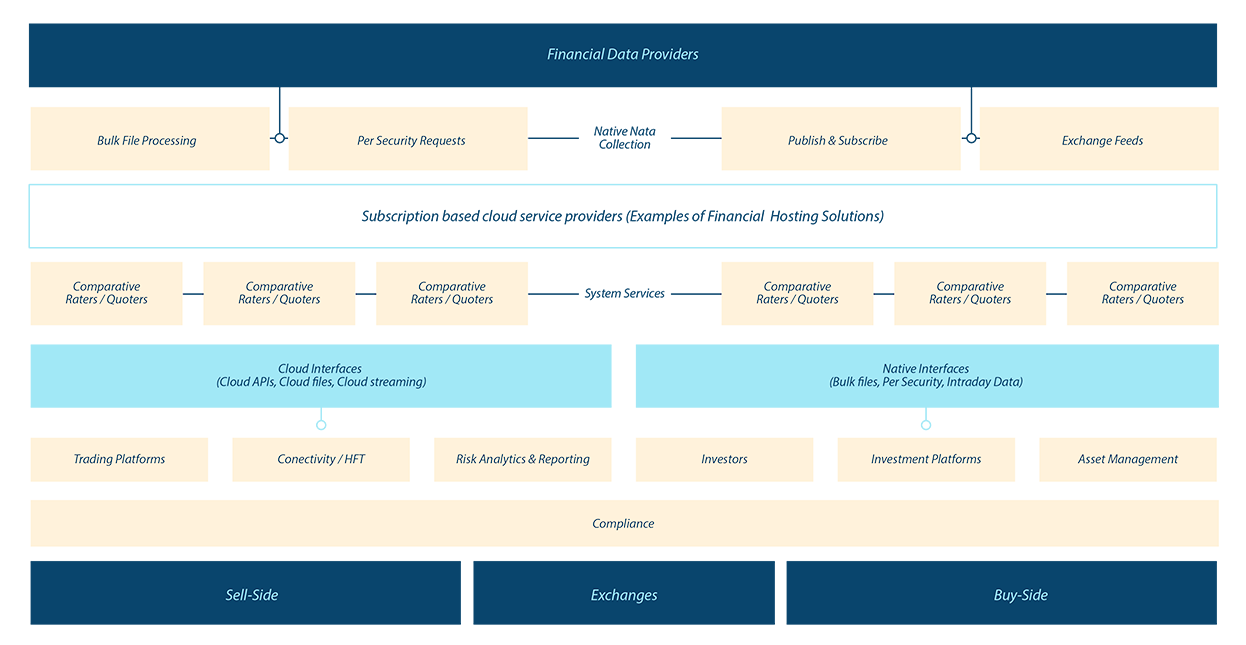

We expect a wave of M&A activity in the next 3 years as payment providers look to catch up with widespread innovation from new entrants, the internet majors scale up in financial services and the technology/software majors add new technology to deepen their offerings in this sector. We have unprecedented access to global investors; we know what they are looking for. We have deep relationships among financial data providers including Bloomberg, Thomson Reuters, Moody's, etc. Many financial data providers are today operating only at the edge of the FinTech revolution. To help engineer more fundamental improvements, they must now embrace new technologies through both organic and inorganic growth strategies.

We have deep relationships among financial data providers including Bloomberg, Thomson Reuters, Moody's, etc. Many financial data providers are today operating only at the edge of the FinTech revolution. To help engineer more fundamental improvements, they must now embrace new technologies through both organic and inorganic growth strategies.